Want to get a business registration number (사업자등록증)? A business license is required for many things. You need it to pay tax (e.g. VAT: value-added tax), advertise on a lot of websites like Naver and post on shopping websites like Gmarket or Coupang. You can register your business in Korea, you need one of the following visas: F visa, D-8–4 Startup visa or D-8 Corporate investor visa. Only for a D-8 corporate investor visa you need a capital investment of $100,000.

This post is about:

- F visas

- Startup / OASIS visa D-8-4

- Company types

- Sole proprietorship

- Corporation

- Accountant

- Korean companies directory

- Business registration number search

F visas

If you have a F-2, 4, 5, 6 visa, you can register a business very easily. You just take your ID and lease agreement to the local tax office (in Korean: 세무서). Follow the link to find a list of tax offices in Naver Maps. Depending on the type of business, you may have to bring additional documents, you may want to call the Seoul Global Center or tax office first. Below is a list of F visas. There are also many sub types of the F visas.

- F-2 Resident (거주)

- F-2-1: Awarded to the spouse of a Korean

- F-2-2: A single-entry visa valid for 90 days or less issued to an underage foreign child of Korean national

- F-2-3: Single-entry resident visa valid for one year or less issued to the spouse of a resident visa holder (F-5)

- F-2-7: Awarded on a points-based system

- F-2-99: May be awarded upon fulfilment of additional requirements after 5 years on an E-2 visa

- F-4 Overseas Korean (재외동포)

- F-4-11: Overseas Korean

- F-4-12: Descendent of Overseas Korean

- F-4-13: Former D or E visa holder

- F-4-14: University Graduates

- F-4-15: Permanent resident of OECD country

- F-4-16: Corporate Executive

- F-4-17: Entrepreneur of $100,000

- F-4-18: Multinational Company

- F-4-19: Representative of overseas Koreans organization

- F-4-20: Government Employee; Overseas Korean with a foreign nationality of a country, who is currently a member of National Assembly, or has worked for 5 years or more at government office/enterprise

- F-4-21: Teacher; Overseas Korean with a foreign nationality of a country notified by the Minister of Justice of ROK, who is a university professor (including associate professor and lecturer), or a teacher at an elementary/middle/high school

- F-5 Permanent resident (영주)

- F-5-11: Special Talent; recognized by the Minister of Justice for his/her excellence in a specific field including science, management, education, cultural arts, and athletics

- F-6 Marriage to Korean Citizen (결혼이민)

- F-6-1: Spouse of a Korean National

- F-6-2: Child Raising; father or mother of minor child born after a marriage with Korean (including de facto marriage), but not qualified for F-6-1 (spouse of Korean citizen), who is raising or is planning to raise the child in ROK

OASIS Visa

Another way is through the OASIS visa, otherwise know as startup visa or D-8-4. You get the OASIS visa when you have enough points. If not, you need to make a minimum investment of 100,000 USD to get the proper visa (D-8, corporate investor) and get the certificate. Below are the requirements for the startup visa.

1. Required Items and Points (225 Points): At least one item is required.

- Intellectual property ownership (registration)

- Intellectual property application

- Co-inventor of owned (registered) intellectual property rights

- 3-year stay on E-3 (Researcher) visa

- OASIS-6, OASIS-9

2. Elective Items and Points (135 Points)

- OASIS-2, OASIS-4

- OASIS-1, OASIS-5, OASIS-7

- Capital of KRW 100 million

- Educational background: Doctoral degree (from a Korean or foreign university), Bachelor’s or Master’s degree (from a Korean university)

- TOPIK level 3 or higher / Completion of KIIP

[Reference]

- Completion of Basic Intellectual Property Course (OASIS-1; Korea Invention Promotion Association) (Elective, 15 points)

- Completion of the Advanced Intellectual Property Course (OASIS-2; Korea Invention Promotion Association) (Elective, 25 points)

- Completion of the Start-up Class (OASIS-4; Korea Immigration Service Foundation and Seoul Global Center) (Elective, 25 points)

- Completion of the Start-up Coaching and Mentoring Service (OASIS-5; Korea Immigration Service Foundation and Seoul Global Center) (Elective, 15 points)

- Achievement of the 3rd or higher prize at invention, start-up exhibitions (OASIS-6; co-hosting) (Required, 25 points)

- Completion of the Start-up Incubator (OASIS-7; Korea Immigration Service Foundation and Seoul Global Center) (Elective, 15 points)

- Foreigner’s business start-up item recognized by the Minister of Justice and selected as a central or local government-supported project (OASIS-9) (Required, 25 points)

Company types

These are the different Korean company types:

- Sole proprietorship or Private Business (사업자 or “sa-eob-ja”)

- Partnership Companies (합명회사 or “hab-myeong hwe-sa”)

- Limited Partnership Companies (합자회사 or “hab-ja hwe-sa”)

- Corporation or Stock Companies (주식회사 or “joo-shik hwe-sa”)

- LLC or Limited Companies (유한회사 or “yu-han hwe-sa”)

Sole proprietorship

If you are thinking of a sole proprietorship, you only need to drop by a district tax office (지방세무) with the lease contract of your office and your Korean ID card (alien registration card: 외국국적등표, or 외국인 체재증) to get a business license. If your landlord agrees you can register your company at your house. Also, it is possible to register more than one person at a sole proprietorship. If you have revenue of around 50,000 USD or more, the tax rate can be quite high for a private business.

Corporation

As for a corporation, you set a foundation capital and incorporate the company first to apply for a business license. For incorporation, you should go to the Seoul Global Center (서울글로벌센터) office after making an appointment or contact a local lawyer.

Seoul Global Center 38 Jong-ro, Jongno-gu, Seoul, 110-792, Korea, 110-792 서울특별시 종로구 종로 38 (서린동) 서울글로벌센터, TEL +82 2 2075 4139 l FAX +82 2 723 3206

Joint stock companies are the best choice for startups, because it is relatively easy to add shareholders and issue loans like convertible bonds. Minimum starting capital for a corporation is 1 million won, roughly 1,000 US dollar. Another thing is that if you have partners you may want to sign a founders’ agreement so when things don’t go as planned you have security.

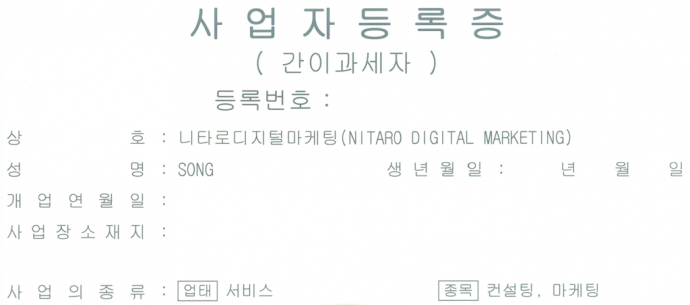

Finally, it is very important which categories (e.g. service, with sub category advertising agency) you choose to put your company under. It is quite a hassle and expensive to add categories (업태) and sub categories (종목) later. For example, you need minutes of the shareholder meeting. And, you need to go the central tax office in Gangnam.

Accountant

It is not legally necessary to have an accountant as a (stock) company, but it is highly recommended. Because when you are incorporated you have to submit income tax every year, VAT returns every quarter, payroll and electronic invoices every month or you get a penalty. A Korean speaking accountant usually costs 100,000 KRW (100 USD) per month. An English speaking one often costs around 150K won.

Korean companies directory

If you are looking for a Korean companies directory, there are several:

Business registration number search

If you want to look up more info about a Korean company, most websites are in Korean. Example: Dart. Also the ones that offer data in English often do not have a database of all companies in Korea. Example: BizInKorea.

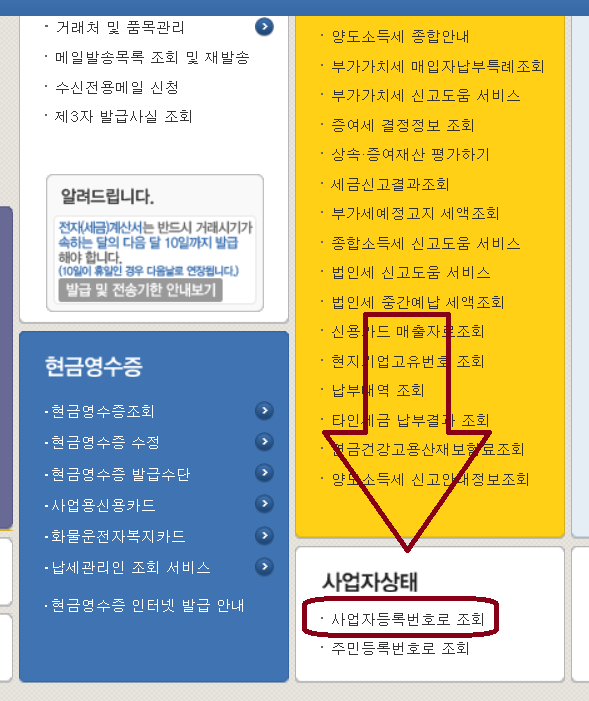

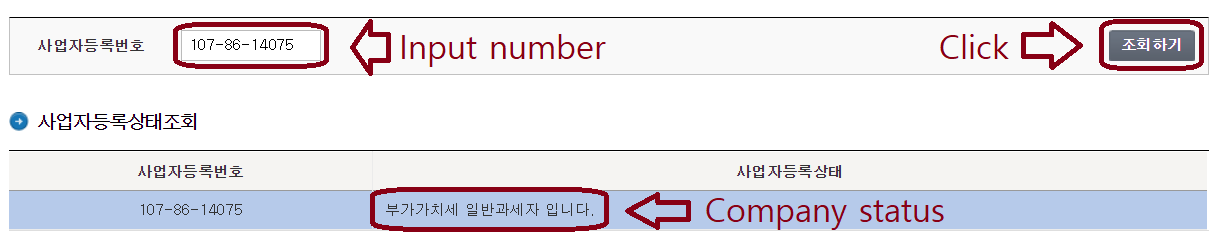

To find out if any company in Korea is active, you can check the Hometax website, officially run by the governmental National Tax Service (NTS). Hometax is where people and businesses in Korea pay / receive their tax (returns) and send electronic invoices. Unfortunately the website is only in Korean. Below are screenshots to find the status of the company in Korea. You need to input the business registration number.

Example of a business registration certificate:

Dear Sir,

Do universities in South Korea also have Certificate of business registration?

As a foreigner invited to speak in Korea, my invitation from Chonnam National University was not enough without the Certificate of business registration.

pls. advise

Thank you.

Hi Myra, thank you for your comment. Yes, universities also have a business registration. The Korean name spelling is: 대학교 사업자 등록증. You can find images on Google if you type that search query.

Is it possible to obtain a Business registration number if my visa is D-2. I am a student but I would like to sell handmade products on Gmarket. Is there any ways to do it?

Hi Tiana, you can try to register as a personal (not a company) seller. The link is here: https://sslmember2.gmarket.co.kr/Registration/MemberRegistrationSeller (Korean). Perhaps you can try to register as a foreign company, not sure if that is possible. If it doesn’t work you can try to sell your products (in consignment) through a third party. Or finally, you can try and get a startup visa.

Hi, how to know where exactly to find the Business Registration No. in a Korean Business Registration Cert?

Hi Tia, you can find the number at the top of the certificate. It says: 등록번호.

Hello. I want to become e-commerce (re-seller) in Korea, but wondering if only ID and Contract of office is enough. Any recommendations or info please advise) business model is in short [ finding customer through Alibaba profile > receiving an order from them > fulfilling their orders directly from China ] – I do it in SK, and receive money from customers and send to suppliers. Thanks

Hi Ira, as far as I know you need a business registration and e-commerce license to sell things online in Korea. https://www.nitaro.net/2016/12/digital-marketing-registration-%ED%86%B5%EC%8B%A0%ED%8C%90%EB%A7%A4%EC%97%85-%EC%8B%A0%EA%B3%A0%EC%A6%9D/

Hi JK Song, do the same things apply for starting an online business? For example selling on Etsy? And being able to receive payments through PayPal? Thank you.

Hi Merve, not sure how Etsy works exactly. But I think anyone can sell there from anywhere.

Hi,

I’m currently holding a D2 visa. Can I change it to D8-4 visa with points and then register a business with the D8-4 visa? After holding D8-4 visa for a year, it can be converted to F2-7 visa with points?

Do you suggest sole proprietorship or company if it’s a one person ecommerce business? Would the tax amount be high?

Hi Izzy, for specific questions about visa it is probably better to contact Seoul Global Center or the immigration office. Contact details of SGC are below. The corporate tax rate is lower than for sole proprietorship, but this is only when you have yearly revenue above 20-30K USD. But you may want to double check with an accountant or tax lawyer.

Seoul Global Center 38 Jong-ro, Jongno-gu, Seoul, 110-792, Korea, 110-792 서울특별시 종로구 종로 38 (서린동) 서울글로벌센터, TEL +82 2 2075 4139 l FAX +82 2 723 3206

Hi if I have the name of the corporation, is it possible to check if the company is a real company?

Hi KK, if you have the company name, yes you should be able to get more info about the company in one of the directories.

Hi, i want to look for a company for the shareholder ownership, may i know which website should i visit to get the information?

Thanks so much for your help!

Hi Sandy, if the company is private I think it will be very difficult to find out the shareholders. As far as I know no website publishes this info. If the company is public (stock listed), you can probably find shareholder info in their annual reports or on websites that cover these kind of companies (Yahoo/Google/Naver Finance, for example).

Hey,

Thanks for the post! Very helpful. I wanted to know how to check the license number of a Korean employment/recruiting agency?

Thank you!

I currently holding a F2 visa and I plan to sell street food in Korea. Where do I have to register my small business? I heard that I have to take a class if I want get a business license.

Do you have any information regarding registration for street food? Thanks

You just take your ID and lease agreement to the local tax office (in Korean: 세무서). Follow the link to find a list of tax offices in Naver Maps. Depending on the type of business, you may have to bring additional documents, you may want to call the Seoul Global Center or tax office first. https://map.naver.com/?query=%EC%84%B8%EB%AC%B4%EC%84%9C&type=SITE_1&siteOrder=

Hi – How long does it take to get a business registration number from the day all information is submitted? Thanks

Hi Maryann, it could take a few days. But like all government agencies, there can be exceptions. Perhaps better to call the (local) tax office or Seoul Global Center!

Thank you! I have another question, I have received a certificate, however it has a different layout than the sample above. What is the best way to confirm that the one I have is authentic.

Hi Maryann, there can be different layouts for different (type of) companies as far as I know. As long as it is from the tax office I am pretty sure it is authentic.

Dear Sir,

I have Business registration Number. how to download business Registration certificate online

Hi Kuldeep, the tax office will give a hard copy version.

Hi Sir,

I am interested in opening an online business while having F visa, Would please share the process where to go and what documents do i need to take with me, how much money do i need to open the online sole proprietor business

Hi Moeez, like I wrote in the post you have to go to a local tax office.

Dear Mr. Song,

I am a foreigner having F Visa and would like to start a business by importing products and selling online in South Korea.

Could you please let me know how much registration of this kind of private business costs?

Do I need to show minimum amount of bank balance to apply for registration of private business.

Thanking you very much

With regards

Pawan

Hi Pawan, as far as I know there is no cost (except perhaps processing fee) or other conditions involved.

Interesting article. However, I have a slightly different issue about which I hope you may be able to give some insight.

I hold an F3 Spouse visa and am trying to determine how (if it is at all possible) to register a non-profit (not-for-profit) charity in Korea. Any insights on this would be greatly appreciated.

Hi, not sure. Probably best to check with Seoul Global Center.

Sir! Please currently how long does it take to complete the business registration and get the certificate ready

Hi, it usually takes a few days.

How can a foreign business request a business certificate?

Hi MChoPa, it is possible. The company has to make a branch office or subsidiary. Best to contact a lawyer.

Found your article very helpful. How does the VAT process works if you have a register business as a sole proprietor under f6 but have not launch your business for about a year yet or generated revenue?

Thanks for your very informative article

As long as you don’t have revenue, you don’t have to report taxes. But you may want to check with an accountant.

Hi,

I have an F-6-1 visa, and I need to get a Korean certificate of business registration. What is the lease of agreement that is needed too along with my ID?

Hi, the lease agreement is the contract between your landlord (office or home) and you.

Hi,

If i own my own place in Korea, do i bring the document of property ownership that is under my name?

Thank you.

In that case you don’t have to bring anything I think, but you may have to contact the (local) tax office. Maybe you can just tell them the address, that could be enough. Then they will verify the ownership of the property.

Thank you so much for your help!

Hi,

Thank you for this article. If someone were to sell food online in Korea (F6 visa holder), what would be needed? I know I would have to register as a business but do I need special certificates for selling food online?

Extras fees? If you know the answer or have a link, that would be great. Thank you.

You will also need the license to sell online: https://www.nitaro.net/2016/12/digital-marketing-registration-%ed%86%b5%ec%8b%a0%ed%8c%90%eb%a7%a4%ec%97%85-%ec%8b%a0%ea%b3%a0%ec%a6%9d/.

Hi. How can I find the registration number of a korean university? I need this number, but the univ didn’t reply me yet. Chungnam National University.I have found a certificate that has ‘충남대학교산학협력단’, I get confused with the 산학협력단. Is there any chance the number of this certificate is the university registration number?

Thank you.

Not sure if Korean universities have business registration numbers. But 충남대학교산학협력단 is probably not what you are looking for. You can try asking the university.

hi sir may i ask if it possible for an E7 visa holder to have a online business permit .

Hi Romeo, I am not an expert in immigration services or an attorney. So perhaps better to ask the immigration office or Seoul Global Center.

Hi there! this is amazing information! I was wondering how the tax works then for sole propiertorship with an F visa.

Thank you! Probably best to check with an accountant!

Good day!

Thank you so much for this wonderful article. I was wondering is it possible for someone on an E-2 visa to sell products on G-Market…etc if their business is registered under a Korean national? Would this be considered legal?

yes I think it would